The housing market slide that began during late 2006 and picked up speed in 2007 has become a full-fledged disaster in 2008. Housing starts are at their lowest level since anyone started keeping track, and prices continue to fall. Neither developers nor lenders are willing to start new projects, and analysts say the market may not turn around for at least three or four years.

Statistics for housing starts and sales indicate that the Central Valley and the Inland Empire are the hardest-hit areas, with starts down by more than 90% in places such as Merced and the Yuba City/Marysville area. Sales of new single-family houses in San Bernardino and Riverside counties have fallen by 80% since the first quarter of 2006. Stockton, Modesto and Merced continue to be national foreclosure leaders.

Housing starts for the year are projected to reach only 66,000 statewide, according to the California Building Industry Association. That's down nearly 70% from the 2004 and 2005 peaks of about 210,000 starts per year, and down 50,000 units from last year's weak performance. For 2009,the CBIA – which is usually overoptimistic – predicts only 67,000 starts.

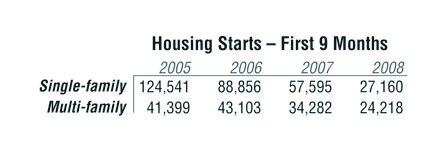

The bright spots – or at least the less dim spots – are in multi-family housing projects, especially those in urban areas and close to transit. While single-family starts have dropped 78% in three years, multi-family starts have decreased "only" 41%.

"Housing starts tend to fluctuate considerably, especially in areas like the Central Valley and the Inland Empire where there is more available land and fewer regulations," said Jed Kolko, an economist at the Public Policy Institute of California. "On the coast, where there is less available land and more regulation, we see much less fluctuation over time. So, the change in housing construction in San Francisco and San Jose, for instance, is much milder than what we see in inland parts of the state."

Depressing anecdotes and horror stories abound from around the state:

• When a bankruptcy trustee tried to auction off SunCal's 6,000-lot McAlister Ranch project in Bakersfield, which has a Greg Norman-designed golf course and infrastructure in place, nobody came to the auction.

• The price of raw land in the Bakersfield area as fallen from about $150,000 an acre to less than $20,000 an acre.

• The median price of a single-family house in Contra Costa County sunk to $295,000 in September, down 50% in one year, according to DataQuick.

• Three out of four sales in Merced County are foreclosure sales.

• Real estate agency Dyson and Dyson, which deals primarily with upper-end homes, has closed all of its Coachella Valley offices.

• Because of cash flow constraints, Pleasant Hill-based Delco Builders has stopped all construction despite having entitlements in hand for a number of subdivisions.

• DR Horton, the largest homebuilder in the country, has put thousands of acres of raw and entitled land across California on the market at prices less than what the company paid.

• Pardee Homes asked for and received a one-year extension on a 500-home development in Canyon Country.

• SunCal suspended work in October on redevelopment of the Oak Knoll Naval Medical Center in Oakland, where the company plans nearly 1,000 housing its and some retail space. SunCal paid $100.5 million for the property three years ago.

• A proposed 39-story condo and hotel tower overlooking Petco Park in downtown San Diego went bust in October, and the lender took over the property.

• Developers with entitlements to build 1,500 housing units and a shopping center at The Village at Mission Lakes in Desert Hot Springs appear to have walked away after partially completing two commercial structures.

• Developers of three condominium towers in downtown San Jose have received the city's permission to rent the vast majority of units because sales virtually stopped.

• Watt Communities has put on hold its plan to build two five-story, mixed-use buildings containing more than 200 housing units in downtown Pomona.

• Nearly every reuse project at the former Fort Ord military base in Monterey County is on hold, including the ballyhooed, new urbanist East Garrison development (see CP&DR Local Watch, January 2006).

• Fresno's high-profile Running Horse project – 800 houses around a Jack Nicklaus-designed golf course – is mired in bankruptcy with no houses built. Donald Trump considered buying the project but backed out when the city declined to provide a subsidy (see CP&DR Deals, December 2007).

• Stalled development of a country club housing project in Placer County forced developer CC Myers to declare bankruptcy.

"The reality on the development side of things," said Renata Simril, Forest City Residential West senior vice president, "is that if projects have got development permits and have got their financing, but they have not started construction, they are holding."

Approved projects that lack financing have almost no chance of moving forward in the near future, Simril added. "The debt market has completely frozen up," she said.

"The banks are continually raising the equity requirement," said Donald Brackenbush, who heads the real estate advisory firm Public Private Ventures. "Now it's up to 40% or even higher, and you have to get your project appraised. But they don't know how to appraise it because there aren't any comps."

"Those that borrowed money to buy land will give it back to the bank, or they will simply turn to dust," Brackenbush said.

What happened? Essentially, explained Delores Conway, director of the Casden Real Estate Economics Forecast at University of Southern California's Lusk Center, the system went from a flood of capital to a drought of capital in a short period. "There were a lot of available loans around at very attract interest rates" for both builders and homebuyers, she said. "What's amazing is that the credit markets have dried up and are fueling this decline."

"Where a lot of those new housing starts were was in the Central Valley and the Inland Empire as everyone was building farther and father out," Conway said. "Overbuilding is always associated with real estate cycles."

Even when there was "overbuilding," however, development industry leaders and state officials said construction was not keeping pace with the state's 500,000-a-year population growth. Six years ago, Brackenbush, who serves on the executive committee of the Urban Land Institute's Los Angeles Chapter, lead a planning exercise to figure out how to house 6 million additional people in Southern California. "Now," said Brackenbush, "not only are we foreclosing and houses are sitting vacant, we're not building any new ones."

Some cities and counties are trying to spur construction. For example, a number of cities in Orange and Sacramento counties and elsewhere have agreed to defer collection of impact fees until the final building inspection stage. Some jurisdictions have postponed scheduled fee increases. The City of Morgan Hill has relaxed its requirement that builders make 13% of new units affordable. But nothing that local government does seems to have much effect.

"We've had some encouraging news in the last few weeks that sales are up a bit and inventory is down," said Robert Rivinius, president of the CBIA. Still, construction is very slow. He recommended that Congress pass a true tax credit for homebuyers – unlike the program approved earlier this year that Rivinius said is more of a loan. He also urged local governments to reduce impact fees, and the state to create a permanent funding source for affordable housing.

Simril said now is the time for governments to undertake aggressive planning. She cited the City of Los Angeles' specific plan process for about 600 acres of industrial land at the Cornfields and Arroyo Seco. The process is likely to result in preservation of some industrial uses, but also in identification of mixed-use development opportunities and upzoning for high-density housing. The city also is preparing a master environmental impact report. All of this will ease the process for builders, she said.

What Los Angeles is talking about may be where the market is headed. Real estate devaluation, the number of available exurban units, high energy costs and even state policy appear to be changing the homebuilding and homebuying calculus.

"What's happening now is that different real estate products are becoming desirable," said Conway. "The developers are not going to do these huge developments where they build hundreds of houses way out there."

Rivinius conceded that the few houses getting built are smaller and less fancy. "Many builders are changing their product some to make their homes for affordable. I think you'll continue to see that," he said.

Noting that land prices have not fallen so sharply in coastal urban areas, Brackenbush predicted that high densities and transit will be the focus of future housing development.

"They said in 1981, ‘Stay alive 'til 85,'" Brackenbush recalled. "They said in 1991, ‘Stay alive 'til '95.' I don't know what they are saying now. 2015?"

Contacts:

Delores Conway, USC Lusk Center for Real Estate, (213) 740-4836.

Renata Simril, Forest City Residential West, (213) 488-0010.

Donald Brackenbush, Public Private Ventures, (626) 795-0919.

Jed Kolko, Public Policy Institute of California, (415) 291-4483.

Robert Rivinius, California Building Industry Association, (916) 443-7933.

CBIA housing starts and sales statistics: www.cbia.org/go/cbia/newsroom/housing-statistics/